Want to know your company's true value? Understanding your net worth isn't just about numbers; it's about making strategic decisions that fuel your business's growth. This guide will walk you through the process of determining your company's net worth, whether you're using online tools or seeking traditional valuation methods.

Company Net Worth Lookup: Understanding Your Business's Value

Determining your company's net worth is crucial for securing funding, attracting investors, and making informed decisions about your business's future. But how do you accurately assess this vital metric? This guide simplifies the process, offering actionable steps and insights.

Why Knowing Your Company's Net Worth Matters

Think of a yearly health checkup for your business. Regularly assessing your company's net worth provides a clear picture of its financial health, revealing strengths and weaknesses. This crucial information empowers you to make smart decisions about growth, investments, and long-term planning. Ignoring this valuable insight can significantly hinder your business’s potential. For small and medium-sized enterprises (SMEs), in particular, a clear understanding of net worth is vital for sustainable success. Isn’t it important to know where you stand financially as you move your business forward?

Finding Your Company's Worth: Your Options

Historically, obtaining a business valuation was a complex and costly undertaking, often requiring specialized expertise and significant time investment. However, the landscape is changing. The emergence of affordable and accessible online tools provides faster and simpler ways to estimate your company's net worth – often with comprehensive reports summarizing their findings.

How to Value Your Company: Different Valuation Methods

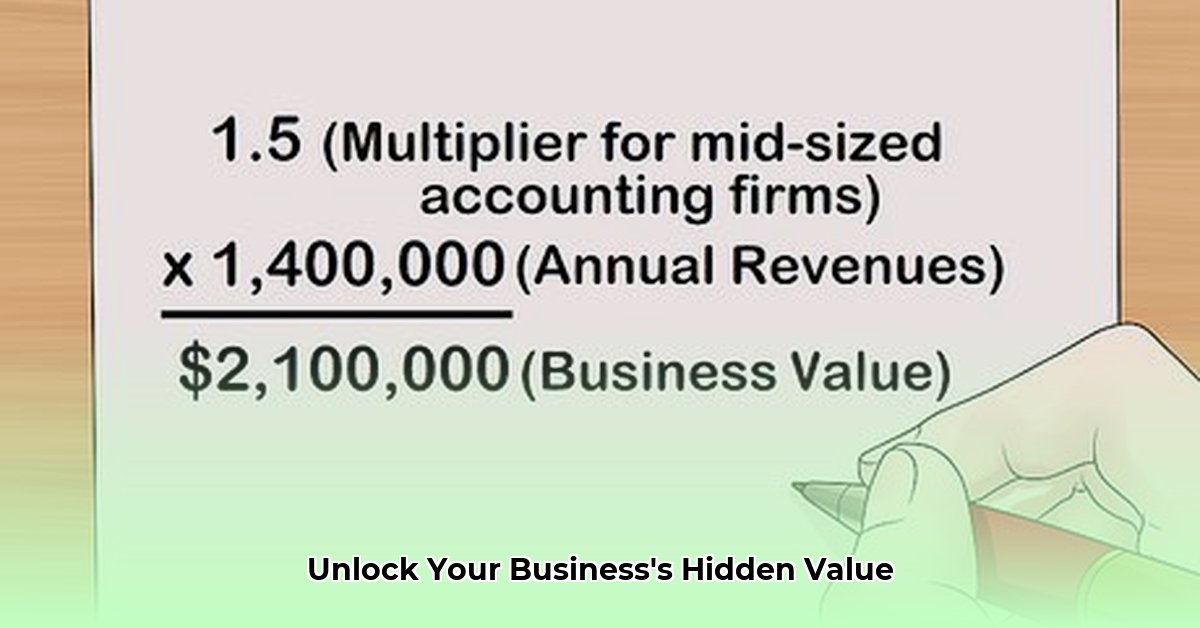

Several methods exist for valuing a company, each providing a unique perspective:

Asset-Based Valuation: This straightforward method focuses on the value of your company's assets (equipment, buildings, inventory, intellectual property). It's particularly useful for businesses with significant tangible assets.

Equity Valuation: This method centers on the owners' stake after liabilities are settled. It's a good indicator of the owner's return on investment.

Enterprise Valuation: This comprehensive approach considers the total value of your business, including debts. It's particularly relevant for mergers, acquisitions, or securing substantial investments.

Liquidation Valuation: This method estimates the value of your business if all assets were sold immediately. It's often used in distressed situations but can offer a valuable baseline valuation.

Choosing the right method depends on your specific circumstances and goals. Consulting with a financial advisor can help you determine the most suitable approach.

Leveraging Online Tools for Company Valuation

Many online platforms offer streamlined estimations of company net worth. These platforms often provide step-by-step processes, simplifying data input and generating personalized reports in a more timely and affordable manner than traditional methods. However, it’s crucial to remember that online tools provide estimates, not definitive valuations.

The Limitations of Automated Valuations

While convenient, online valuation tools have limitations. Their estimates are not as precise as professional appraisals, especially for complex business structures or when substantial financial decisions are involved. Always review results critically and consult a financial professional for a comprehensive assessment, particularly regarding large financial decisions.

A Step-by-Step Guide to Determining Your Company's Net Worth

Follow these steps for a more accurate understanding of your company's true worth:

Research Your Options: Explore different online valuation tools, comparing features and pricing to find the best fit for your needs and budget, taking advantage of free trials if available.

Gather Your Financial Data: Collect all necessary financial information (financial statements, tax returns, etc.), ensuring accuracy and organization for seamless processing.

Conduct the Valuation: Use your chosen online platform or consult a professional, carefully weighing the costs and benefits of each option.

Analyze the Results: Carefully review the report, understanding the factors influencing the valuation, noting areas of strength and potential weaknesses.

Seek Expert Advice: Discuss your findings with a financial advisor to gain valuable insights and guidance on interpreting and utilizing this information in your strategic planning.

Plan for the Future: Use the valuation as a springboard for informed decision-making, including business expansion, loans, and strategic investments.

Regularly assessing your company's net worth is proactive financial management. Empower yourself with knowledge to make confident business decisions. The more informed you are, the better equipped you'll be to navigate the dynamic business landscape.

Comparing Online and Traditional Business Valuation Methods

Choosing the right valuation method depends heavily on your needs and the context of the valuation. Let's compare the strengths and weaknesses of online and traditional approaches.

Online Valuation Tools: Speed vs. Accuracy

Online tools offer speed and convenience, providing a quick estimate. They're useful for:

- Early-stage businesses needing a general sense of worth.

- Quick benchmarking against similar companies.

However, their inaccuracies are a noteworthy limitation:

- Limited data, often neglecting unique business aspects.

- Simplification can miss crucial factors like brand value or intellectual property.

- Unreliable for major transactions (selling, securing significant funding).

Traditional Business Appraisals: Precision at a Price

Traditional appraisals offer detailed, in-depth analysis. They’re ideal for:

- Significant transactions (mergers, acquisitions, substantial financing).

- Meeting legal reporting requirements.

- Long-term strategic planning.

The increased accuracy comes with drawbacks:

- Higher costs.

- Time-consuming (weeks or months).

- Complexity may require professional guidance to interpret.

Choosing the Right Method: A Comparative Table

The best method depends on your specific context:

| Stakeholder | Online Tool | Traditional Appraisal |

|---|---|---|

| Small Business Owner | Initial estimates | Major transactions |

| Large Corporation | Internal benchmarking | Legal compliance |

| Investor | Initial screening | Due diligence |

Remember that your choice should be driven by your financial goals and the implications of the valuation. Consider your business stage, transaction significance, and budget constraints.